Yesterday, Bitcoin and Ethereum remained under pressure, failing to receive support from major players despite attempts to break through key resistance levels. After dipping to around $130,400, Bitcoin is currently trading at $104,600, retaining the potential for a deeper decline toward $100,000. Ethereum also saw some buying interest near $2,472 but has yet to demonstrate strong bullish momentum.

Despite the Federal Reserve easing inflation fears at yesterday's meeting, Bitcoin and Ethereum continue to struggle. Under such circumstances, demand for risk assets would typically return, as the potential for rate cuts may be greater than the Fed projects. However, the lack of strong bullish impulses may lead to a new and much larger crypto market sell-off in the near future.

A notable positive news report yesterday was that 151 public companies now hold BTC on their balance sheets. This figure represents a 135% year-over-year increase, signaling growing institutional interest in Bitcoin and recognition of its potential as a hedging and portfolio diversification tool. Broader adoption of BTC among public companies may contribute to price stabilization and reduced volatility over the long term. That said, the volume of BTC held by these companies remains relatively small compared to total market capitalization. Furthermore, macro factors and retail sentiment still heavily influence Bitcoin's price.

Nevertheless, the increasing number of public firms holding BTC is an important step toward further institutionalization and its acceptance as a legitimate investment vehicle. This may also draw more regulatory attention and help define clearer rules for the crypto market.

In my intraday strategy for the cryptocurrency market, I will continue to make decisions based on significant drawdowns in Bitcoin and Ethereum, anticipating that the bull market will continue to develop in the medium term, as it remains intact.

As for short-term trading, the strategy and conditions are described below.

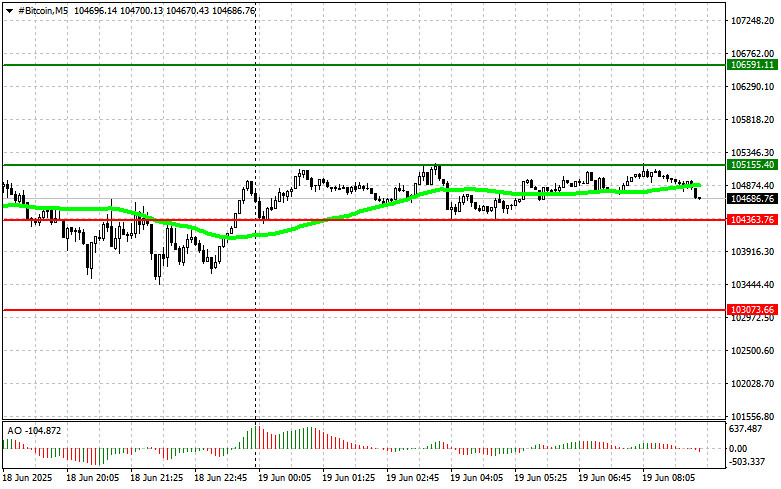

Bitcoin

Buy Scenario

Scenario #1: Buy Bitcoin at $105,100, targeting a rise to $106,600. Exit long positions at $106,600 and open a short position on a rebound.

Conditions: Before executing the breakout buy, ensure the 50-day moving average is below the current price, and the Awesome Oscillator is in positive territory.

Scenario #2: Buy from the lower boundary at $104,300 if there is no follow-through market reaction on its breakout, targeting $105,100 and $106,600.

Sell Scenario

Scenario #1: Buy Bitcoin at $105,100, targeting a rise to $106,600. Exit long positions at $106,600 and open a short position on a rebound.

Conditions: Before executing the breakout buy, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: If there is no follow-through market reaction to its breakout, buy from the lower boundary at $104,300, targeting $105,100 and $106,600.

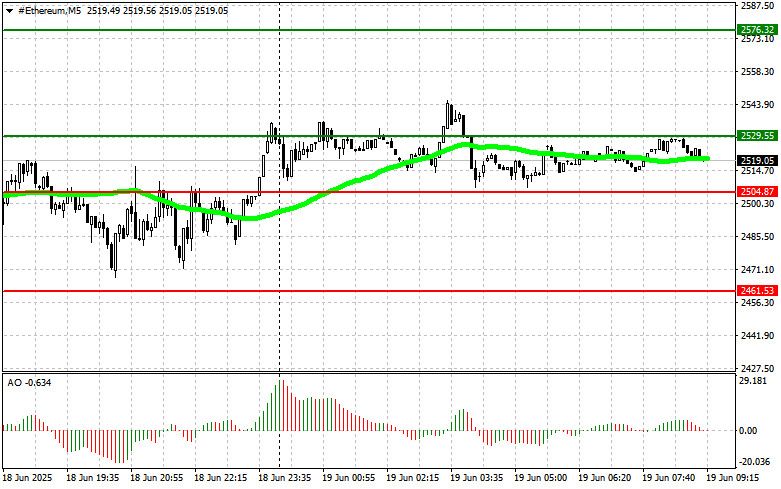

Buy Scenario

Scenario #1: Buy Ethereum at $2,529, targeting a rise to $2,576. Exit long positions at $2,576 and open a short position on a rebound.

Conditions: Before the breakout buy, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: If the market does not react to its breakout, buy from the lower boundary at $2,504, targeting $2,529 and $2,576.

Sell Scenario

Scenario #1: Buy Ethereum at $2,529, targeting a rise to $2,576. Exit long positions at $2,576 and open a short position on a rebound.

Conditions: Before the breakout buy, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: If the market does not react to its breakout, buy from the lower boundary at $2,504, targeting $2,529 and $2,576.