Trade Review and Advice for Trading the Euro

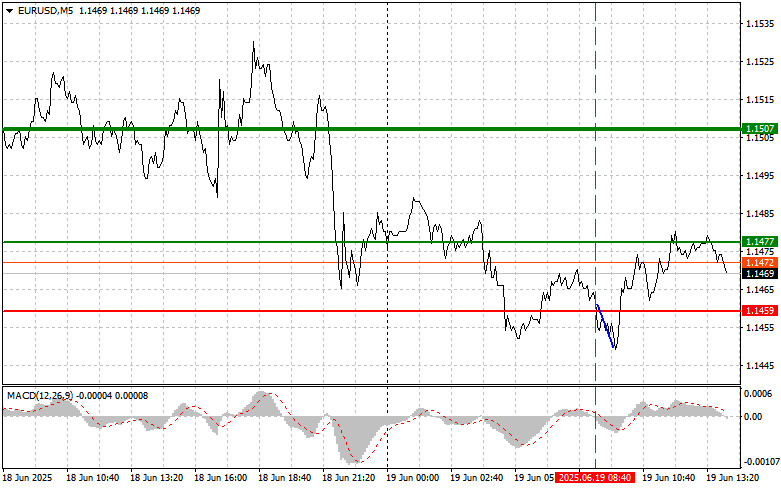

The test of the 1.1459 price level in the first half of the day coincided with the MACD indicator just beginning to move down from the zero line, confirming the correctness of the entry point. However, a major drop in the pair did not materialize.

Clearly, the euro received temporary support due to the absence of important economic data from the eurozone. Nevertheless, this is merely short-term stabilization. In the medium term, the euro remains under pressure due to several key factors. First is inflation, which may rise again in eurozone countries despite the recent decline. Second is the new energy crisis triggered by geopolitical instability, which could negatively affect the eurozone economy.

Today, due to the lack of significant U.S. economic news in the second half of the day and the upcoming holiday, major market fluctuations are not expected. However, this doesn't mean complete inactivity. Rather, we can expect fewer sharp moves and more moderate, predictable asset behavior.

Stay alert for news from the Middle East and statements from Trump regarding Iran, which could cause sudden and unexpected market movements at any moment.

As for intraday strategy, I will mostly rely on Scenarios #1 and #2.

Buy Signal

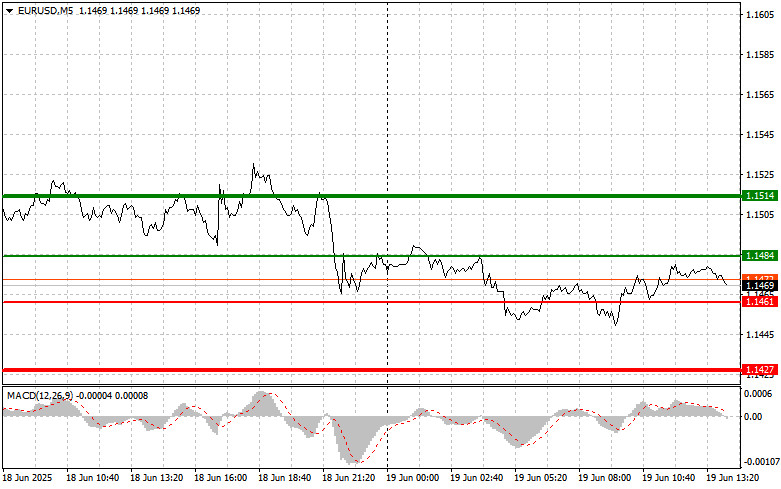

Scenario #1:You can buy the euro today upon reaching the price level of 1.1484 (green line on the chart) with a target of rising to 1.1514. At 1.1514, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30–35 point move from the entry point. A strong euro rally is unlikely today. Important! Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2:I also plan to buy the euro today if there are two consecutive tests of the 1.1461 price level, while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a market reversal upward. A rise toward 1.1484 and 1.1514 can be expected.

Sell Signal

Scenario #1:I plan to sell the euro after it reaches 1.1461 (red line on the chart). The target will be 1.1427, where I intend to exit the market and buy immediately in the opposite direction, aiming for a 20–25 point rebound from the level. Pressure on the pair may resume if the Iran situation worsens. Important! Before selling, ensure that the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2:I also plan to sell the euro today if there are two consecutive tests of the 1.1484 level, while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a downward reversal. A decline toward 1.1461 and 1.1427 can be expected.

Chart Guide:

- Thin green line – Entry price to buy the trading instrument

- Thick green line – Estimated price to set Take Profit or close the position manually, as further growth is unlikely above this level

- Thin red line – Entry price to sell the trading instrument

- Thick red line – Estimated price to set Take Profit or close the position manually, as further decline is unlikely below this level

- MACD Indicator – When entering the market, it is important to consider overbought and oversold zones

Important:Beginner Forex traders must make market entry decisions with great caution. It's best to stay out of the market before the release of major fundamental reports to avoid being caught in sharp price fluctuations. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you could quickly lose your entire deposit, especially if you're trading large volumes without proper money management.

And remember, successful trading requires a clear trading plan, like the one outlined above. Spontaneous decisions based on current market movements are a losing strategy for intraday traders.