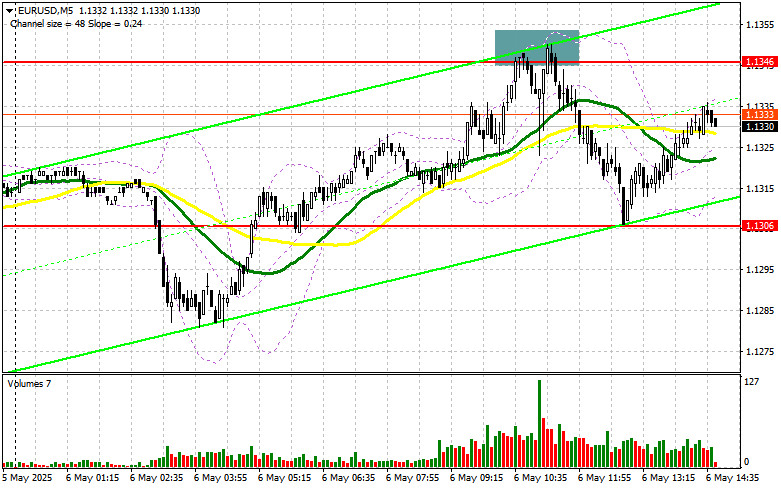

In my morning forecast, I highlighted the 1.1346 level and planned to make trading decisions based on it. Let's take a look at the 5-minute chart and analyze what happened there. The rise and formation of a false breakout around 1.1346 led to an entry point for selling the euro, resulting in a drop of the pair to the level of 1.1306. The technical picture was not revised for the second half of the day.

To open long positions on EUR/USD:

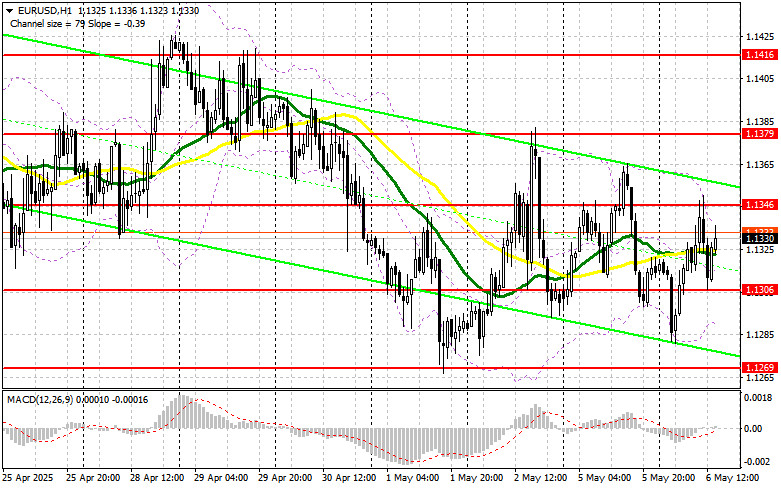

The revised upward PMI services data from eurozone countries led to a slight strengthening of the euro against the dollar in the first half of the day. During the U.S. session, figures on the U.S. trade balance and the RCM/TIPP Economic Optimism Index are expected. If the data is weak, which is more likely, pressure on the dollar will return. In the case of strong data, I would prefer to act on a decline in the 1.1306 support area. A false breakout there, similar to what occurred earlier, will be a reason to buy EUR/USD in anticipation of a market rebound with a return to the 1.1346 level. A breakout and retest of this range will confirm a valid entry point, with the next target at 1.1379. The furthest target will be 1.1416, where I plan to take profit. If EUR/USD declines and shows no activity around 1.1306, pressure on the pair will increase significantly, potentially leading to a stronger downward move. In that case, the bears may push the pair down to 1.1269. I plan to act on long positions only after a false breakout forms there. Immediate long entries will be considered only from 1.1219, targeting an intraday upward correction of 30–35 points.

To open short positions on EUR/USD:

If the euro rises following U.S. data, bears will again need to prove their presence around 1.1346. Only a false breakout there will serve as a signal to enter short positions with a target at the 1.1306 support area, where the moving averages—currently favoring bulls—are located. A breakout and consolidation below this range will be an appropriate setup for selling, targeting 1.1269. The furthest goal will be 1.1219, where I plan to take profit. Testing this level will break the bullish market structure. If EUR/USD rises again during the second half of the day and bears do not act around 1.1346 (already tested once today), buyers may push for a retest of 1.1379. I will only sell there after a failed consolidation. Short positions on a rebound will be considered from 1.1416, targeting a 30–35 point downward correction.

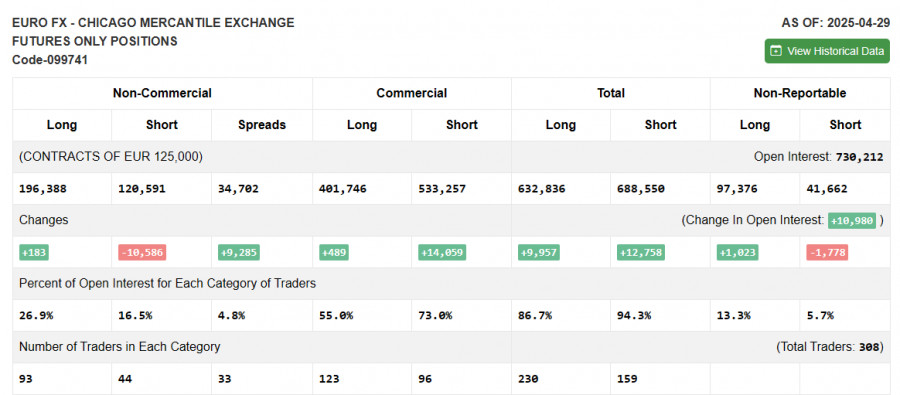

COT Report (Commitment of Traders):

The COT report from April 29 showed a rise in long positions and a decrease in shorts. Considering that the European Central Bank plans to continue lowering interest rates, this fact remains a limiting factor, preventing the euro from returning to a bullish market. Meanwhile, an upcoming Federal Reserve meeting is expected to leave borrowing costs unchanged, which supports the U.S. dollar. According to the COT report, long non-commercial positions increased by 183 to 196,388, while short positions decreased by 10,586 to 120,591. As a result, the gap between long and short positions widened by 9,285.

Indicator Signals:

Moving Averages: Trading is taking place around the 30- and 50-period moving averages, indicating market uncertainty.

Note: The author considers the period and prices of moving averages on the H1 hourly chart, which differs from the standard definition on the D1 daily chart.

Bollinger Bands: In case of a decline, the lower boundary of the indicator around 1.1290 will act as support.

Indicator Descriptions:

- Moving Average (MA): Smooths volatility and noise to define the current trend. Period 50 (yellow), Period 30 (green).

- MACD (Moving Average Convergence/Divergence): Fast EMA – period 12, Slow EMA – period 26, SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain criteria.

- Long non-commercial positions: Total long open interest held by non-commercial traders.

- Short non-commercial positions: Total short open interest held by non-commercial traders.

- Total non-commercial net position: The difference between non-commercial long and short positions.