Analysis of Trades and Trading Tips for the Euro

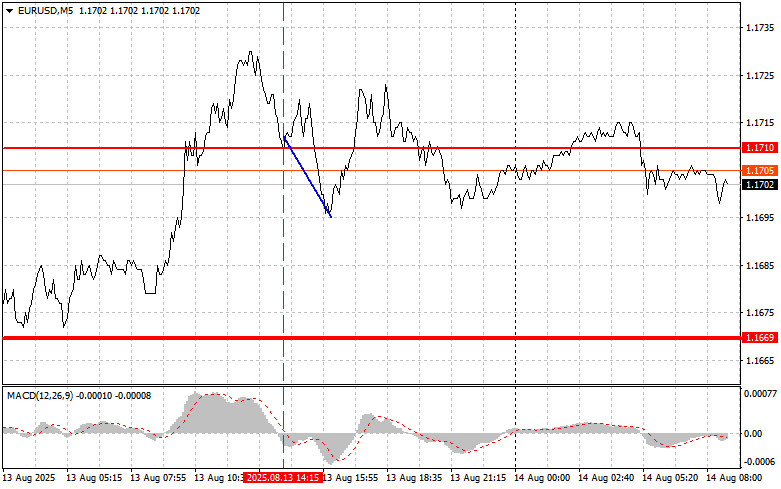

The test of the 1.1710 price level occurred at a time when the MACD indicator was starting to move down from the zero mark, which confirmed the correct entry point for selling the euro and resulted in a 15-point drop.

The European currency continued to show signs of strength, maintaining its upside potential. Yesterday's conflicting statements from Federal Reserve officials allowed the euro to retain a leading position. Despite the restrained comments from some Fed members, the overall situation remains unclear. Goolsbee, advocating for decision-making based on current data, emphasized that further policy will depend on incoming economic information. This, in turn, increases market volatility and makes the euro an attractive target for speculative trades. Other Fed representatives supported a softer policy, provided that the labor market continues to show signs of slowing.

Today, traders will focus on the European economy. The key event will be the release of updated euro area GDP data for the second quarter. This report will provide important information about the pace of economic recovery. Special attention will be given to changes in employment. An increase in jobs would be a positive sign, confirming the stability of the labor market and consumer confidence. At the same time, slower employment growth could signal potential economic problems and negatively affect the euro. Also important is the report on industrial production for June. This indicator reflects the state of the economy, showing demand and supply dynamics in the manufacturing sector. Forecasts point to modest growth, but any unexpected results could cause significant fluctuations in the currency market.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

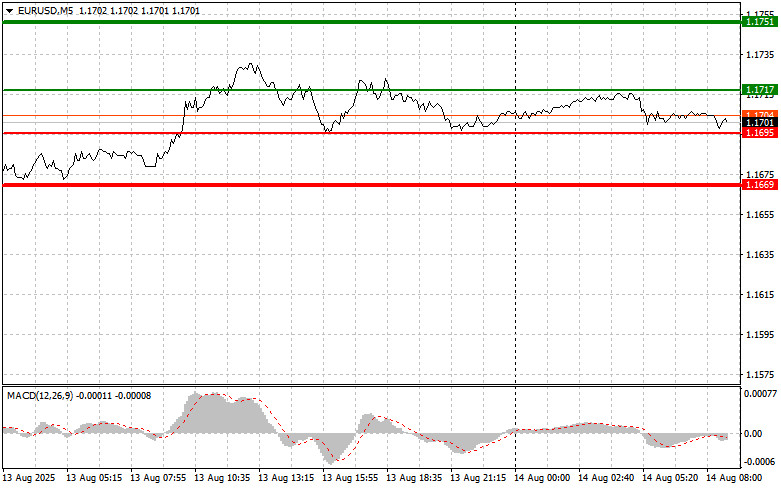

Scenario No. 1: Today, buying the euro is possible when the price reaches around 1.1717 (green line on the chart) with a target of rising to 1.1751. At 1.1751, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30-35-point move from the entry point. Euro growth can be expected within the observed upward trend. Important! Before buying, ensure the MACD indicator is above the zero mark and starting to rise from it.

Scenario No. 2: I also plan to buy the euro today if there are two consecutive tests of the 1.1695 price level at a time when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward reversal. Growth can be expected toward the opposite levels of 1.1717 and 1.1751.

Sell Scenario

Scenario No. 1: I plan to sell the euro after reaching the 1.1695 level (red line on the chart). The target will be 1.1669, where I intend to exit the market and immediately buy in the opposite direction (expecting a 20-25-point move in the opposite direction from the level). Strong pressure on the pair is possible today after the release of weak data. Important! Before selling, ensure the MACD indicator is below the zero mark and is just starting to move down from it.

Scenario No. 2: I also plan to sell the euro today if there are two consecutive tests of the 1.1717 price level at a time when the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a reversal downward. A decline can be expected toward the opposite levels of 1.1695 and 1.1669.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.