Analysis of Trades and Trading Tips for the Euro

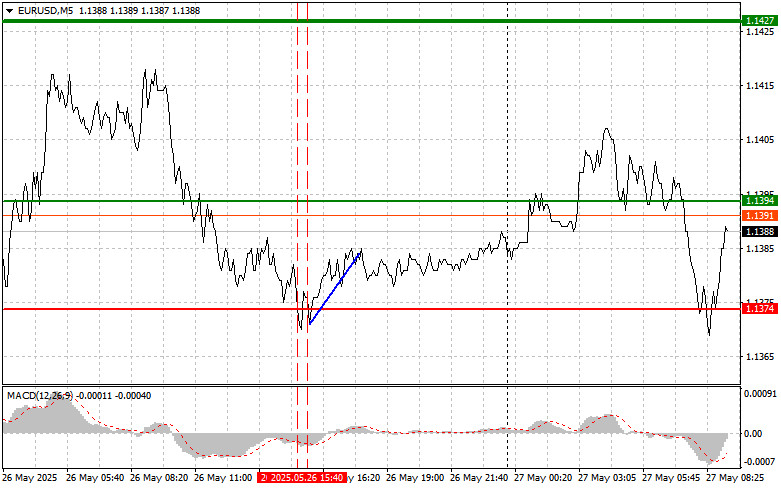

The first test of the 1.1374 price level in the second half of the day occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's downward potential. A short while later, another test of this level occurred, which triggered the execution of Buy Scenario #2, resulting in only a 10-pip rise in the pair.

Today is set to be an eventful day in the financial markets, with several key developments that could affect the EUR/USD pair. The release of the German GfK Consumer Climate Index is of primary importance, a leading indicator that offers insights into consumer sentiment and expectations regarding future economic developments. Moderate figures are expected, which will help assess the resilience of consumer demand amid current inflation and the geopolitical instability caused by U.S. tariffs.

Also on today's agenda is the French Consumer Price Index, a key measure of inflation that reflects changes in the cost of goods and services. Observers will evaluate how effective the French government has been at controlling inflation, which has been relatively successful in recent months.

In addition, Bundesbank board member Joachim Nagel is scheduled to speak. He is expected to analyze the current economic situation in Germany and the eurozone and offer his assessment of monetary policy prospects. Markets will be paying close attention to any signals regarding potential changes in interest rates or the European Central Bank's quantitative easing program.

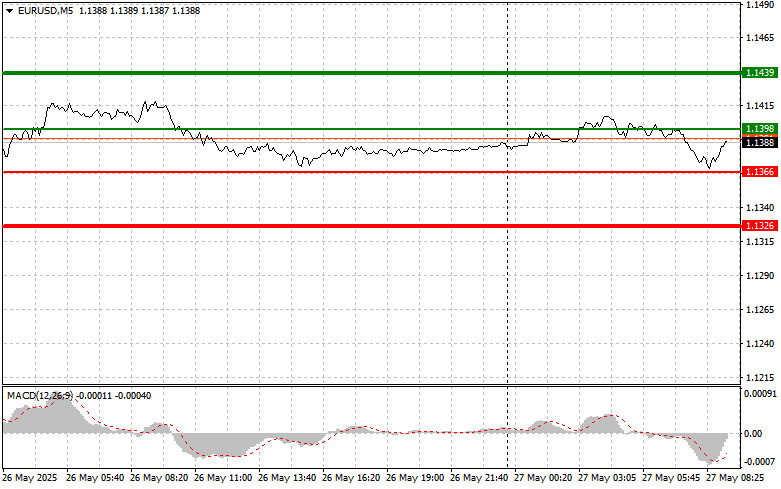

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

Scenario #1: I plan to buy the euro today if the price reaches around 1.1398 (green line on the chart), targeting a rise to 1.1439. At 1.1439, I plan to exit the market and sell the euro in the opposite direction, aiming for a 30–35 pip retracement from the entry point. Further euro growth is possible following yesterday's news.

Important! Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1366 price level while the MACD is in the oversold zone. This would limit the pair's downside potential and trigger a bullish reversal. A rise toward 1.1398 and 1.1439 can then be expected.

Sell Scenario

Scenario #1: I plan to sell the euro after the price reaches 1.1366 (red line on the chart), with a target of 1.1326, where I'll exit the position and buy immediately on the rebound (aiming for a 20–25 pip retracement). Strong downward pressure on the pair is likely only if economic data disappoints.

Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to fall.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1398 level while the MACD is in the overbought zone. This would cap the pair's upward potential and lead to a bearish reversal. A decline toward 1.1366 and 1.1326 may then follow.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.