GBP/USD 5-Minute Analysis

The GBP/USD currency pair also resumed its upward movement on Wednesday, thanks to Donald Trump. Recall that yesterday, Trump imposed 25% tariffs on India, and earlier in the week, he had also announced new tariffs. In short, absolutely nothing has changed in Trump's policy. We believe he will continue slapping tariffs on every country he can remember for a long time to come. Thus, as we have warned, there is still no sign of de-escalation in the global trade war. Even the few deals the Trump administration has signed change nothing, as they include the same tariffs as before. The GBP/USD pair stayed flat for a few days, but then resumed its movement north. We expect this to continue.

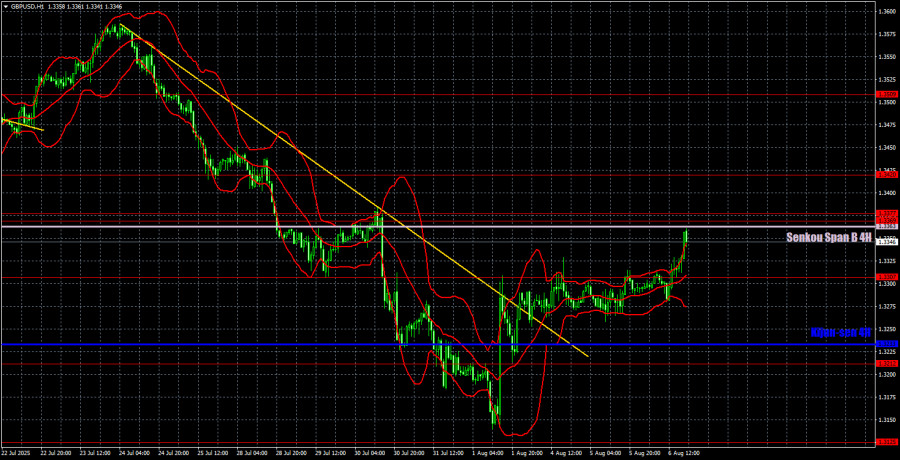

From a technical standpoint, the pair still needs to break through the Senkou Span B line on the hourly time frame, at which point the trend will entirely shift to bullish. Although the trend technically turned bullish as soon as the trendline was breached. The fundamental backdrop is once again putting intense pressure on the dollar, so we expect nothing other than its decline.

Today, the Bank of England meeting is scheduled, which could theoretically push the pound down. But that's only in theory. In reality, we expect a new local upward trend.

On the 5-minute chart, no trading signals were formed on Wednesday. The pair only approached the Senkou Span B line by the end of the day. Long positions remain much more relevant than short ones.

COT Report

COT reports for the British pound show that in recent years, the sentiment of commercial traders has been constantly changing. The red and blue lines, which represent the net positions of commercial and non-commercial traders, frequently cross and are mainly near the zero mark. They've nearly converged again, indicating an approximately equal number of long and short positions.

The dollar continues to decline due to Donald Trump's policies, so, in principle, the market makers' demand for the pound sterling is currently not particularly significant. The trade war will continue in some form for quite a while. Demand for the dollar will continue to decline. According to the latest report on the British pound, the "Non-commercial" group closed 5,900 BUY contracts and opened 6,600 SELL contracts. Thus, the net position of non-commercial traders fell by 12,500 contracts over the reporting week.

In 2025, the pound rose significantly, but it's important to understand that there was one main reason: Trump's policies. Once that factor is neutralized, the dollar could begin to rise again, but no one knows when that will happen. It doesn't matter how fast the net position for the pound rises or falls. The dollar is falling regardless—and typically at a faster rate.

GBP/USD 1-Hour Analysis

On the hourly time frame, the GBP/USD pair has broken through the trendline, and on the daily time frame, it has already bounced off the key and strong Senkou Span B line. Therefore, the short-term trend has turned bullish. In our view, the fundamental background still favors the British pound over the U.S. dollar, and in the long term, we expect the resumption of the "2025 trend." Trump is once again doing everything to weaken the U.S. dollar.

For August 7, we highlight the following important levels: 1.3125, 1.3212, 1.3369-1.3377, 1.3420, 1.3509, 1.3615, 1.3681, 1.3763, 1.3833, 1.3886. Senkou Span B (1.3363) and Kijun-sen (1.3233) lines can also be sources of signals. It is recommended to set the Stop Loss to breakeven once the price moves 20 pips in the right direction. Note that Ichimoku indicator lines may shift during the day, which should be considered when identifying trading signals.

On Thursday, the BoE will hold its meeting, where a decision on monetary easing may be announced. This would be a bearish factor for the British currency. However, even if a temporary decline occurs today, we would still expect further growth afterward.

Trading Recommendations

We believe that on Thursday, the pair may pull back slightly downward, but it will depend on the BoE's decision. It's quite possible that the central bank will not lower the key rate in August. If it does, a short-term decline is likely. But overall, we continue to look only north.

Illustration Explanations:

- Support and resistance price levels – thick red lines where movement may end. They are not trading signal sources.

- Kijun-sen and Senkou Span B lines—These are strong Ichimoku indicator lines transferred to the hourly timeframe from the 4-hour one.

- Extremum levels – thin red lines where the price has previously rebounded. These act as trading signal sources.

- Yellow lines – trend lines, trend channels, and other technical patterns.

- COT Indicator 1 on the charts – the size of the net position for each category of traders.