Analysis of Monday's Trades

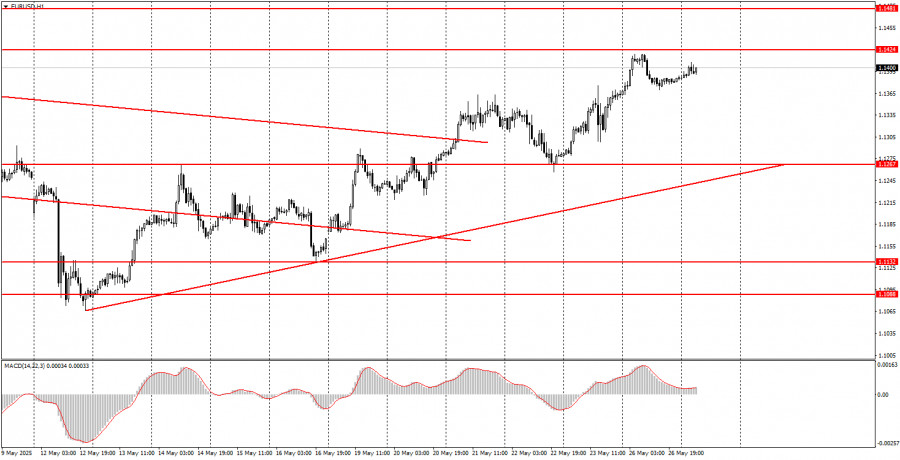

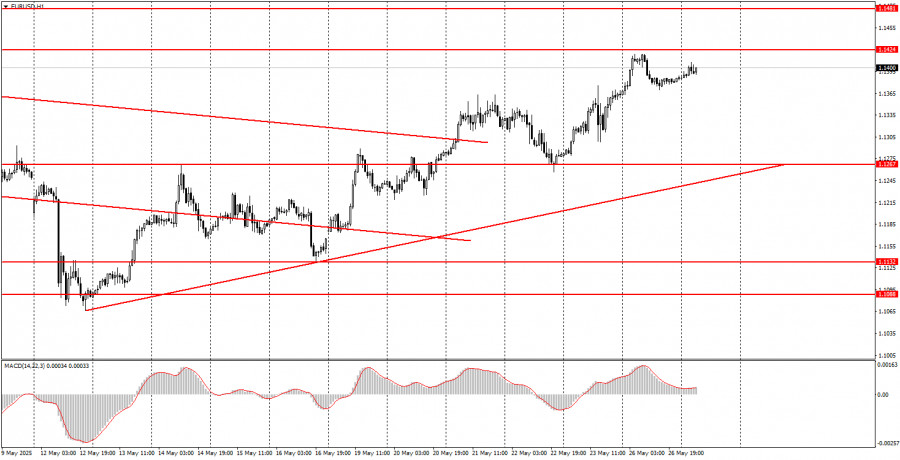

1H Chart of EUR/USD

The EUR/USD currency pair continued its upward movement on Monday, which had started back on Friday. Only in the second half of the day did a slight pullback occur, triggered by Trump's decision to cancel the planned tariff hike on EU goods scheduled for June 1. This time, Trump didn't just change his mind out of the blue. The U.S. President held a phone conversation with European Commission President Ursula von der Leyen, during which it was decided to postpone the tariff increase to allow more time for trade negotiations. The market wasn't particularly excited about this development; the dollar failed to strengthen significantly, and traders were unwilling to pull the pair back to Friday's low, from which the latest dollar decline had started. Thus, it is clear that the market continues to use any excuse to open new short positions against the U.S. dollar. Even when positive news emerges, it's not enough to change the overall negative sentiment toward the dollar and Donald Trump's policies.

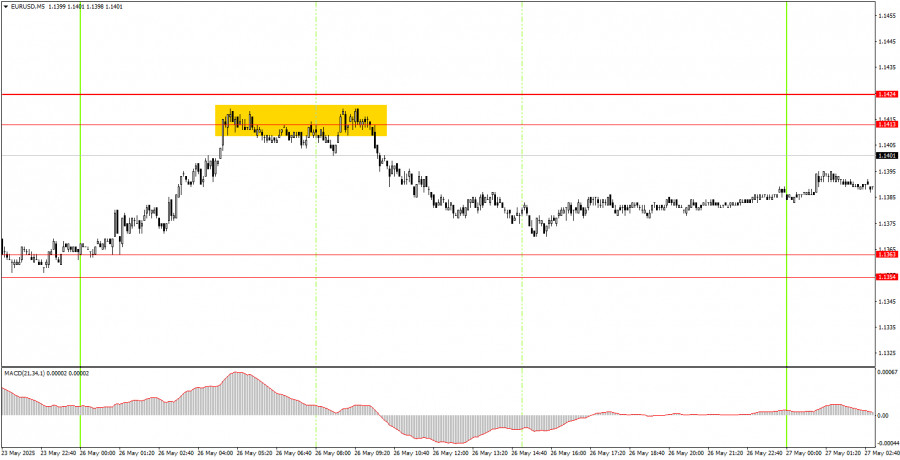

5M Chart of EUR/USD

In the 5-minute time frame Monday, the pair formed only one trading signal. At the beginning of the European session, the price rebounded from the 1.1413–1.1424 area, after which it spent most of the day moving downward. The short trade could have been closed anytime, with an average profit of about 25 pips. Volatility throughout the day was not high.

Trading Strategy for Tuesday:

The EUR/USD pair continues its upward trend in the hourly time frame. It seems that the bullish trend, which began the moment Trump became president, is set to continue. At this point, the fact that Trump is the president of the United States is enough to keep the dollar falling consistently. That alone is a compelling reason for the market to flee the dollar without hesitation. When Trump starts issuing threats, setting ultimatums, and implementing or raising tariffs, the market will have few options.

On Tuesday, the EUR/USD pair may continue moving upward as Trump pressures his trade partners. Even the occasional news pointing to de-escalation in the trade conflict provides little support for the dollar.

In the 5-minute chart, the following levels should be monitored: 1.0940–1.0952, 1.1011, 1.1088, 1.1132–1.1140, 1.1198, 1.1267–1.1292, 1.1354–1.1363, 1.1413–1.1424, 1.1474–1.1481, 1.1513, 1.1548, 1.1571, 1.1607–1.1622. No crucial events or reports are scheduled in the eurozone on Tuesday, while in the U.S., a fairly substantial report on durable goods orders will be released. This report may theoretically support the dollar, but only marginally. It won't have any real impact on the trend.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.