Analysis of Trades and Trading Tips for the British Pound

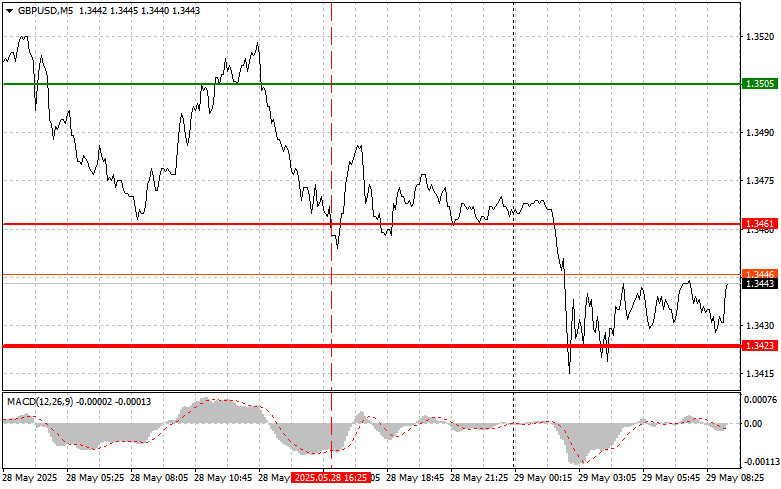

The price test at 1.3461 in the second half of the day occurred when the MACD indicator had already significantly moved below the zero mark, which limited the pair's downside potential. For this reason, I did not sell the pound.

After the news that the U.S. Federal Trade Court had annulled Trump's global reciprocal tariffs, the British pound experienced a sharp drop, wiping out all the gains accumulated during the current month. This plunge was an unexpected blow to investors who were counting on the continuation of the upward trend, supported by hopes for the recovery of the British economy and the easing of monetary policy by the Bank of England. The court's decision effectively nullified a key element of the U.S. administration's trade policy, triggering a re-evaluation of risks in the currency markets. Moreover, uncertainty surrounding the administration's future trade policy actions also weighs on the pound. Investors fear that the removal of tariffs might only be the first step toward broader changes in the U.S.'s trade relations with other countries, potentially creating new risks for the UK economy, which is closely tied to global markets.

With no UK economic data set for release today, the focus will likely shift to speeches from members of the Bank of England committee. Traders will closely analyze Sarah Breeden's rhetoric for signals about possible changes in the regulatory landscape of the financial sector. Her comments on the banking system's stability, potential risks related to lending, and the adequacy of bank capital may significantly influence investor sentiment. Andrew Bailey's speech, in turn, will be viewed as a key indicator of the BoE's monetary policy trajectory. Traders and analysts will be looking for hints about when the central bank plans to begin cutting interest rates and assessing his views on the strength of the economic recovery and the risks of recession.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

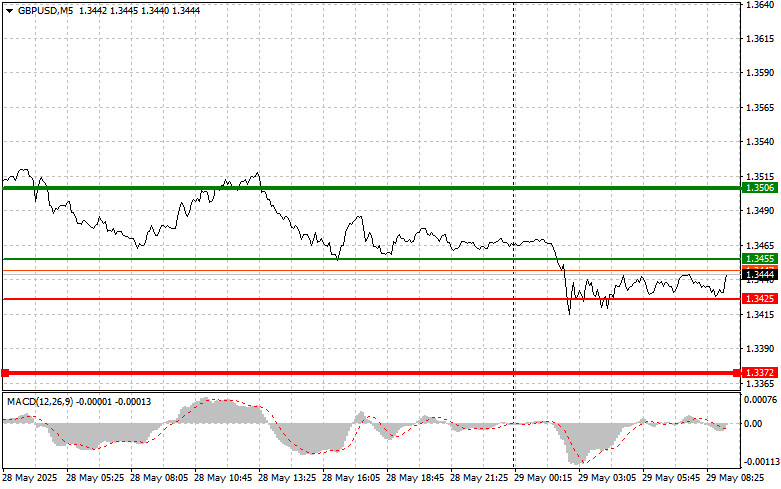

Scenario #1: I plan to buy the pound today upon reaching the entry point around 1.3455 (green line on the chart), with a target of rising to the 1.3506 level (thicker green line on the chart). Around 1.3506, I plan to exit purchases and open short positions in the opposite direction (expecting a 30–35 pip retracement from the level). Expecting a rise in the pound today should be limited to a corrective movement.

Important! Before buying, ensure the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.3425 price level while the MACD indicator is in the oversold area. This would limit the pair's downside potential and lead to an upward reversal. A rise to the opposite levels of 1.3455 and 1.3506 can be expected.

Sell Scenario

Scenario #1: I plan to sell the pound today after a breakout below the 1.3425 level (red line on the chart), which would lead to a sharp drop in the pair. The key target for sellers will be the 1.3372 level, where I plan to exit the market and immediately open purchases in the opposite direction (expecting a 20–25 pip retracement from the level). Selling the pound is advisable after a failed attempt to break above the daily high.

Important! Before selling, make sure the MACD indicator is below the zero mark and just starting to fall from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.3455 level while the MACD indicator is in the overbought area. This would limit the pair's upside potential and lead to a downward reversal. A decline toward the opposite levels of 1.3425 and 1.3372 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.