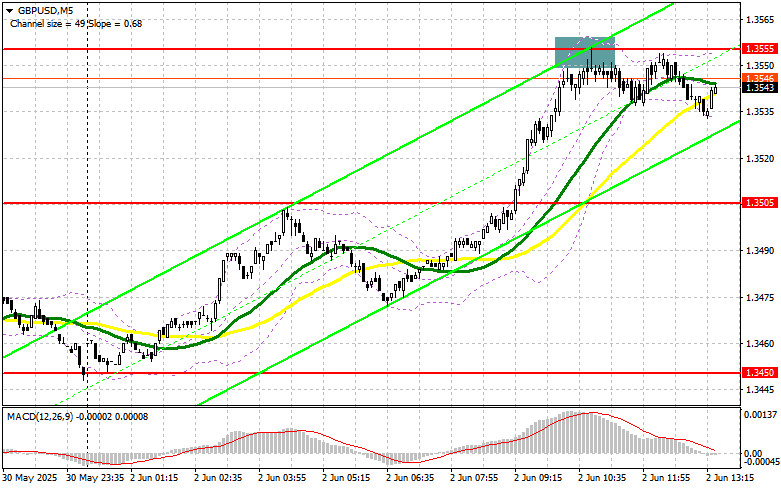

In my morning forecast, I focused on the 1.3555 level and planned to base market entry decisions around it. Let's look at the 5-minute chart and analyze what happened. A rise followed by a false breakout at that level led to a sell entry on the pound, resulting in a 20-point drop in the pair. The technical outlook was not revised for the second half of the day.

To Open Long Positions on GBP/USD:

The pound rose nicely on the back of a strong Manufacturing PMI report, which exceeded economists' forecasts. However, the second half of the day may not be as favorable as the first. Important U.S. ISM Manufacturing PMI data for May will be released, and only weak statistics would allow the GBP/USD pair to extend its gains. Additionally, FOMC member Lorie K. Logan and Fed Chair Jerome Powell are scheduled to speak. Their comments, especially on recent inflation data and interest rate outlooks, could significantly impact the pair.

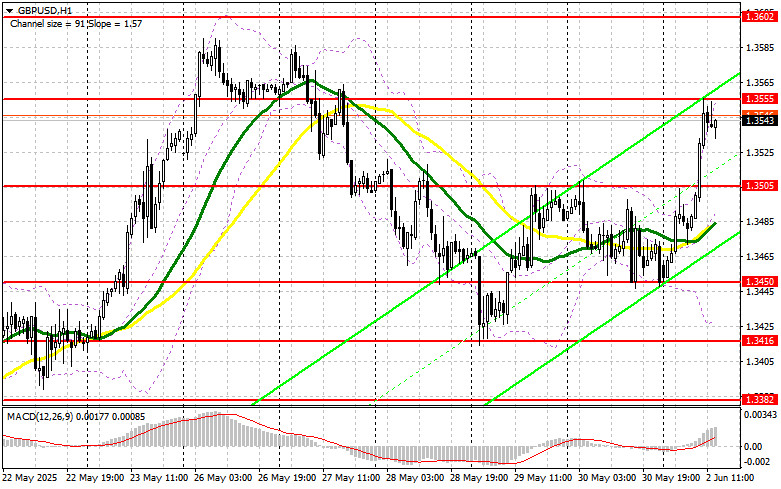

In case of a decline, I prefer to act near the 1.3505 support, which served as resistance in the morning. A false breakout there will offer a good entry point for long positions targeting a return to the 1.3555 resistance, which has so far held firm. A breakout and retest from above will provide another entry point, with the prospect of an advance to 1.3602, restoring the bullish market. The ultimate target will be the 1.3637 area, where I plan to take profit. If GBP/USD falls and there is no bullish activity around 1.3505, pressure on the pound could return. In that case, only a false breakout near 1.3450 would be a suitable condition for opening long positions. I also plan to buy GBP/USD immediately on a rebound from the 1.3416 support, targeting a 30-35 point intraday correction.

To Open Short Positions on GBP/USD:

Sellers tried but failed to cause a larger drop, although they successfully defended 1.3555. In case of another upward spike in GBP/USD, I plan to act only after a false breakout at the 1.3555 resistance, similar to the setup discussed earlier. This would be enough for a sell entry targeting a drop toward the 1.3505 support. Just below this level, the moving averages favor the bulls. A breakout and retest from below would trigger stops and open the path to 1.3450. The ultimate target will be the 1.3416 area, where I plan to lock in profits.

If demand for the pound remains strong later in the day and bears fail to show resistance at 1.3555, it would be better to postpone selling until the 1.3602 resistance is tested. I will open short positions there only after a false breakout. If there is no downward movement even there, I will look for a sell entry on a rebound near 1.3637, targeting a 30-35 point downward correction.

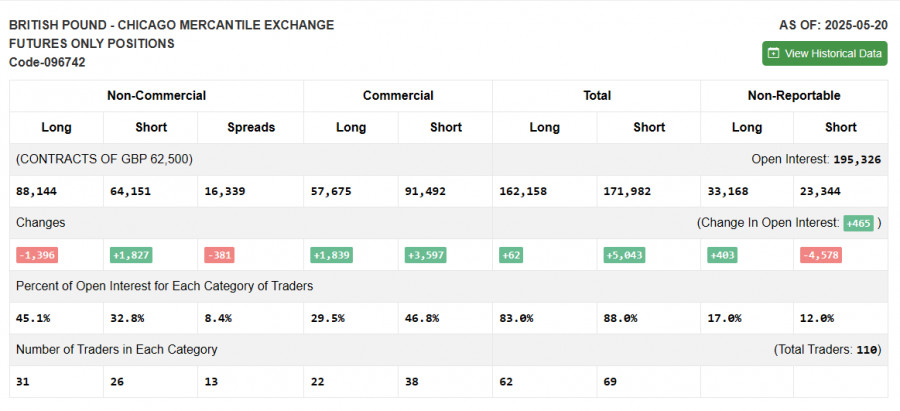

COT Report (Commitments of Traders):

The COT report from May 20 showed a reduction in long positions and an increase in short positions. Despite the UK and the U.S. having signed a trade agreement, demand for the pound remains fairly strong, even as the Bank of England is expected to cut interest rates. Similar plans from the Federal Reserve weigh on the U.S. dollar's strength, allowing the pound to continue rising. With no major statistics expected from the UK soon, there are fewer reasons for large players to sell the pound. The latest COT report shows that long non-commercial positions fell by 1,396 to 88,144, while short non-commercial positions increased by 1,827 to 64,151. As a result, the gap between long and short positions narrowed by 381.

Indicator Signals:

Moving Averages:

Trading is above the 30- and 50-period moving averages, indicating further growth for the pound.

Note: The moving averages periods and prices are based on the author's analysis on the H1 hourly chart and differ from the standard daily moving averages on the D1 chart.

Bollinger Bands:

In case of a decline, the lower band around 1.3420 will act as support.

Indicator Description:

- Moving Average (MA): Defines the current trend by smoothing volatility and noise. Period 50 marked in yellow; Period 30 marked in green on the chart.

- MACD (Moving Average Convergence/Divergence): Fast EMA 12, Slow EMA 26, SMA 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: The total long open positions of non-commercial traders.

- Short non-commercial positions: The total short open positions of non-commercial traders.

- Net non-commercial position: The difference between short and long positions of non-commercial traders.