European markets are holding their breath as investors watch talks and the Fed

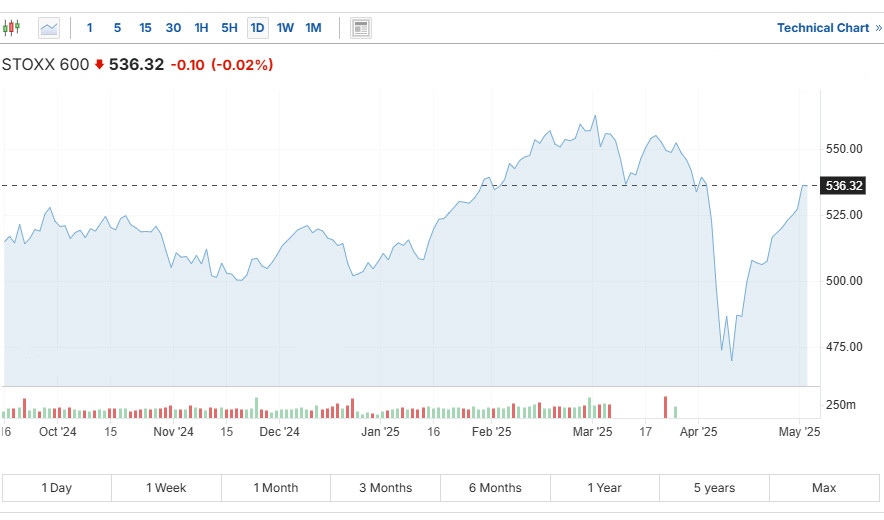

European stock markets started the trading week on a cautious decline on Monday as investors took a wait-and-see approach ahead of key events. The main focus is on the ongoing trade talks between the US and China, as well as the upcoming US Federal Reserve monetary policy meeting. By Monday morning, the pan-European STOXX 600 index had shown a modest 0.1% decline (as of 0709 GMT). At the same time, most regional indices remained positive, with the exception of France's CAC 40, which was down 0.3%.

Trump puts pressure on the Fed again, but Powell remains in office

On Sunday, Donald Trump gave an interview in which he expressed dissatisfaction with the Federal Reserve's policy, once again demanding lower interest rates. Despite this, he stressed that he does not intend to remove the current Fed Chairman Jerome Powell, although he called him "too tough" in his approach to monetary policy.

The Fed is expected to keep rates unchanged at the end of Wednesday's meeting, especially given the strong labor market data for March.

Washington Seeks Compromise: China in Focus

In the same interview, Trump said that the administration is actively negotiating trade agreements with a number of countries, including China. The president made it clear that his main goal in this dialogue is to achieve fair and balanced trade conditions.

These statements fuel market hopes for a possible easing of long-standing trade tensions between the world's two largest economies. Against such expectations, investors remain cautious but optimistic.

Political Surprises: Tariffs on Movies and Alcatraz

In addition to economic topics, Trump made a number of unexpected political statements. He proposed introducing a 100 percent tariff on foreign films, which could cause a storm of discussion in the entertainment industry. In addition, the president ordered the reopening of the famous Alcatraz prison in San Francisco - a decision that has already caused a wide resonance.

Meanwhile, the White House continues to assure the public that Beijing is open to constructive dialogue, and there is reason to hope for the signing of a trade agreement that is beneficial to both sides.

Shell looks at a competitor: the market reacts with a fall

Shell shares, traded on the Amsterdam Stock Exchange, fell noticeably on Monday — quotes fell by 2.8%. The reason was a publication claiming that the energy giant is considering the possibility of buying the British BP. According to sources, Shell has already hired external consultants to assess the potential deal.

This news immediately caused a reaction in the market: participants fear that such a merger could require significant financial investments and affect the current structure of the company's assets. Such corporate maneuvers are often perceived as a signal of uncertainty.

Success in pharma: Novo Nordisk gets the green light from the FDA

In contrast to the oil sector, shares of the Danish pharmaceutical company Novo Nordisk showed growth — quotes rose by 1.1%. The company reported that the American regulator FDA accepted for consideration an application for registration of the oral form of the drug Wegovy — a new means of combating excess weight.

The final decision on the drug is expected to be made in the fourth quarter. This move opens up the prospect of market expansion and strengthening the pharmaceutical giant's position in the field of weight loss drugs, which is rapidly gaining popularity around the world.

Erste Group Bets on Poland

Shares in Austria's Erste Group soared by 5.8% after announcing a strategic acquisition. The financial group announced the purchase of almost half of the assets of Poland's Santander Bank Polska and investment company Santander TFI. The deal was concluded in partnership with Spain's Banco Santander.

For Erste, this means not only an increase in assets, but also a stronger presence in the key Eastern European market. Analysts positively assess this move as a confident move towards consolidation of the banking sector in the region.

London Quiet as Markets Pause

The London Stock Exchange remained closed on Monday for a bank holiday, temporarily dampening overall trading activity on European markets. However, investors used the break to focus on events outside the UK and prepare for a busy week.

Asia at the Start: Taiwan Dollar Rising, Buffett Out

The Asian trading session was relatively quiet, with trading volumes down due to bank holidays in several countries. However, traders were drawn to the rise of the Taiwan dollar, adding momentum to the region's markets.

In another significant development, legendary investor Warren Buffett was officially handing over day-to-day management of Berkshire Hathaway. The move, seen as a final handover to a new generation of management, underlines the end of an era, leaving investors to ponder the future of one of the world's largest investment companies.

Taiwan Dollar on the Rise: Markets Guess Currency Revaluation

The Taiwan dollar has been steadily strengthening for the second day in a row, reaching levels not seen in almost three years. This rapid rise — more than 6% in two days, according to LSEG — has become a historical record for the national currency and has caused a storm of speculation in the markets.

Analysts believe that such a sharp strengthening may be associated with the intentions of several Asian countries to weaken their currency dependence and pave the way for more favorable conditions in negotiations with Washington. Although the Taiwanese currency is not officially pegged to any exchange rate, the local central bank is actively monitoring the situation and intervening when necessary to maintain "dynamic stability".

Thin Air on Monday: Global Markets Slow Down

Despite a flurry of political and economic news, trading activity at the beginning of the week remained subdued. Exchanges in the UK, Hong Kong, China, Japan and South Korea were closed due to public holidays. This temporarily froze some operations on global financial markets and reduced trading volumes.

Meanwhile, investors' attention is increasingly shifting to the upcoming decisions of the largest central banks.

Central banks in focus: rates under the microscope

This week, monetary regulators enter the arena. In the spotlight is the Bank of England, which, according to experts, may cut its key interest rate for the first time in a long time. This decision is dictated by the desire to stimulate the economy amid ongoing uncertainty.

At the same time, the central banks of Sweden and Norway are expected to maintain the current parameters of monetary policy, preferring a wait-and-see approach.

Elections in Asia and Canada: stability as a response to turbulence

The weekend's political agenda added a note of predictability to the markets: in Australia and Singapore, the current heads of government retained their posts, repeating a similar scenario that previously played out in Canada. Experts believe that voters are betting on stability and proven figures in the context of international turbulence, largely caused by the unpredictable steps of the United States.

Populism on the rise: far-right candidate wins in Romania

Romania has held the first round of repeat presidential elections, which brought an unexpected lead to George Simion, a well-known far-right politician with pronounced anti-European rhetoric. Simion, who actively uses nationalist and anti-globalist slogans, confidently reached the final of the race, fueling fears about the growth of populism within the European Union.

Political scientists are already calling this success part of a wider trend: voters in Eastern Europe are increasingly looking for "strong leaders" and supporting those who harshly criticize Brussels - in many ways in the spirit of Trump.