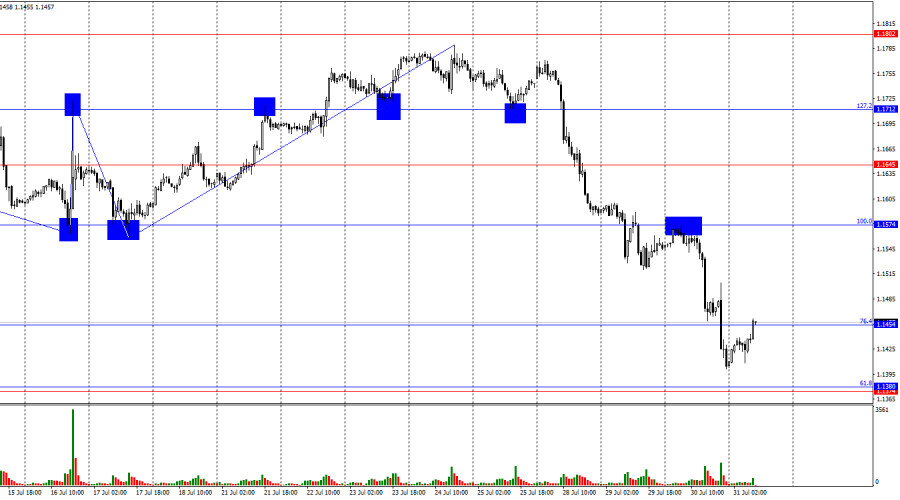

On Wednesday, the EUR/USD pair continued its decline after rebounding from the 100.0% Fibonacci retracement level at 1.1574. By the end of the day, the pair closed below the 76.4% level at 1.1454, opening the way for a further drop toward the support zone of 1.1374–1.1380. A consolidation above 1.1454 would work in favor of the euro and suggest a potential recovery toward 1.1574. Bears remain in control, and for the first time in a while, the news background is clearly supporting them.

The wave structure on the hourly chart remains straightforward. The most recent completed upward wave broke above the previous peak, while the last downward wave broke below the prior low. This indicates a bearish trend, although it has been shifting frequently due to news-driven sentiment. Donald Trump managed to secure several advantageous trade deals, boosting the bears. However, it's worth noting that many of the U.S.'s trading partners have yet to reach an agreement with Washington.

On Wednesday, market attention was focused not on the FOMC outcome itself, but on Jerome Powell's remarks—and for good reason. Lately, the prevailing view had been that the Fed would cut rates twice in the second half of 2025. It's unclear why so many traders and analysts expected this, given that inflation has been accelerating and Powell has consistently stated since the start of the year that the new trade reality is likely to impact consumer prices. One of the Fed's primary targets is to maintain price stability around 2% annual growth. Therefore, if inflation is rising, the Fed has no reason to ease monetary policy. Some concerns had centered around the risk of a U.S. recession, which might force the Fed to cut rates. However, just six hours before the FOMC meeting ended, Q2 GDP data was released showing 3% growth. That evening, Powell indicated that the extent of policy easing by year-end may be less than 50 basis points.

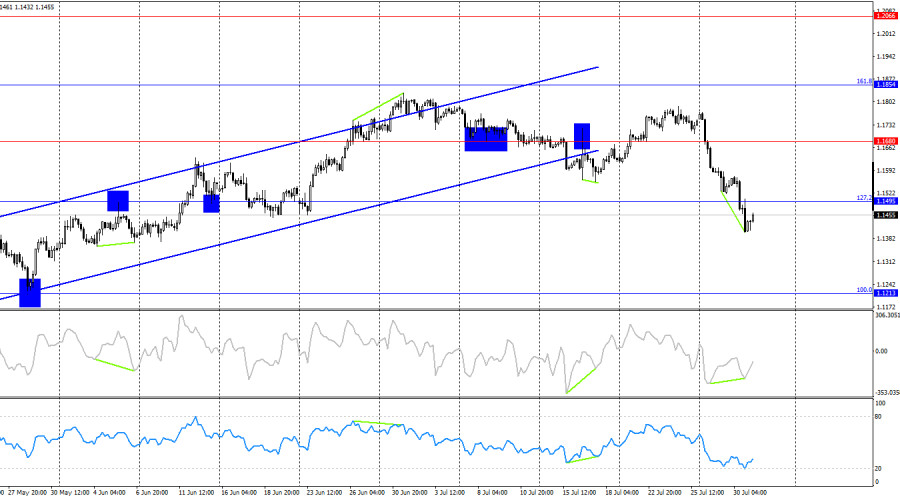

On the 4-hour chart, the pair reversed in favor of the U.S. dollar and closed below the 127.2% Fibonacci level at 1.1495. Earlier, the euro also broke below the ascending trend channel. I'm still hesitant to conclude that a bearish trend has fully formed. The U.S.–EU trade deal gave the bears momentum, but sustained and consistent bearish sentiment is needed for a continued move toward the 100.0% retracement level at 1.1213. The CCI indicator has formed a bullish divergence.

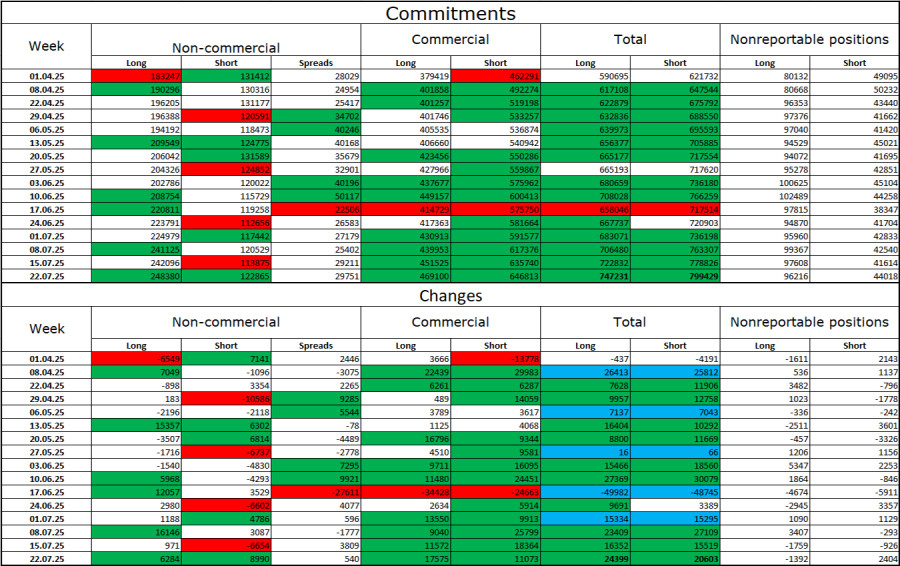

Commitments of Traders (COT) Report:

During the latest reporting week, professional traders opened 6,284 long and 8,990 short positions. Sentiment among the "non-commercial" category remains bullish, largely thanks to Donald Trump, and continues to strengthen. Speculators now hold 248,000 long positions and 122,000 short—more than a 2:1 ratio. Note the large number of green cells in the table above, indicating a strong increase in euro positions. In most cases, interest in the euro continues to grow, suggesting waning interest in the dollar.

For 24 consecutive weeks, large traders have been reducing short positions and increasing long ones. Donald Trump's policies remain the most significant factor for traders, as they could trigger a recession and other long-term structural challenges for the U.S. economy. Despite several major trade agreements being signed, I still don't see a shift in the overall sentiment among institutional players.

Economic Calendar for the U.S. and Eurozone:

- Eurozone – Germany Unemployment Rate (07:55 UTC)

- Eurozone – Eurozone Unemployment Rate (09:00 UTC)

- Eurozone – Germany CPI (12:00 UTC)

- U.S. – PCE Index (12:30 UTC)

- U.S. – Personal Income and Spending (12:30 UTC)

- U.S. – Initial Jobless Claims (12:30 UTC)

The July 31 calendar includes six notable events. While the news background may not trigger strong market moves on Thursday, its influence is expected to be consistent throughout the day.

EUR/USD Forecast and Trader Recommendations:

Selling the pair was possible after a close below 1.1712 with a target of 1.1645. That target, and the next one at 1.1574, were both reached. New selling opportunities emerged after a close below 1.1574, targeting 1.1454—also successfully hit. Today, I do not recommend selling. Buying may be considered if the pair closes above 1.1454, with a target of 1.1574.

Fibonacci levels are plotted from 1.1574 to 1.1066 on the hourly chart and from 1.1214 to 1.0179 on the 4-hour chart.